Rick Kern/Getty Images Entertainment

Boutique fitness, a relatively new term to describe smaller fitness studios that offer specialized workouts, have been quickly capturing much of the broader fitness industry in recent years. Brands like Orange Therapy and Baseline training are everywhere. However, some argue this style of fitness is just a FAD. This couldn’t be further from the truth. An independent study by Frost & Sullivan reported that the boutique fitness industry had a market value of $21 billion in 2019 and is expected to grow at a CAGR of 24.5% through 2025, leaving a $26 billion market.

So which player is going to lead this growth? More importantly, which player has the best business? I believe it’s none other than F45 (NYSE:FXLV).

Now, you probably wondered why I issued a HOLD rating. What’s wrong with the business? Well, nothing actually. The business model is excellent and the company is firing on all cylinders. But, reality trumps optimism. Growth comes at a cost. The cost here is the fees associated with the general marketing and support to the franchisees it licenses. This cost is causing the negative bottom line we saw in 2021. I expect this to eventually change, but for now, I like to see a general trend shift positively before investing.

The F45 Way

So what the heck is F45 anyway? F45 is a boot-camp like fitness studio model that is focused on two things that complement each other with ease: functional training in 45 minutes. That’s it. The pitch is simple, yet effective. Exercise junkies (and those that say they are) come into one of 1,749 studios globally and work their butts off for 45 minutes.

Let’s face it, nobody today (that I know of) wants to work out for 2 hours, its sub-optimal and time consuming. Instead, people are turning to 45-minute workouts because it maximizes the effectiveness of the workout whilst simultaneously getting the same endorphin release from a 2-hour workout.

Here’s the best part. According to a report by exercise.com, boutique fitness represents 40% of the fitness industry. Within the boutique fitness industry, F45 operates in the boot-camp/cross-training segment, which represents only 4.5%. The leading segment is personal/small group training with 13%. F45 falls into this also, but it’s not its main pitch point.

Anyway, you look at it, one does not need to be overly-optimistic to see the growth opportunity for both the overall boutique fitness industry and the segments within it.

The Business Model

F45 generates revenue through its franchising model. Prospective franchisees seek licenses to operate their own F45 studios. With this, revenue can be broken down into 2 components: Franchise revenue and Equipment and merchandise revenue.

Franchise Revenue

Once a franchisee is approved, F45 charges a number of fees:

1) Establishment fee: up to $50,000 upfront franchisee fee

2) Monthly franchisee fee: $2500 fixed or 7% of revenue (depends on monthly AUV)

3) Renewal Fee: $25,000 renewal fee at end of contract

4) Other franchise related fees: these are monthly marketing and technology fees

5) Merchandise, meals and supplements: various branded products; done by ordering

You may have noticed that numbers 2, 4 and 5 are actually recurring fees. A “one and done” approach is outdated and leaves revenue on the table. By having a number of frequent recurring fees, F45 is able to allow stable revenue generation in its business. Another point I want to make here is that number 2 has a variable franchise fee. This means that real value exists in improving AUVs, helping both F45 and the individual franchisee in the long-run.

Equipment and Merchandise

Other fees include:

1) World Pack: a $150,000 studio equipment and technology charge

2) Equipment refresh and replacement: replacement sales; done annually and ad hoc

The Financials

Now that we understand how F45 makes its money, it’s time to see how it’s performed over the years.

Revenues

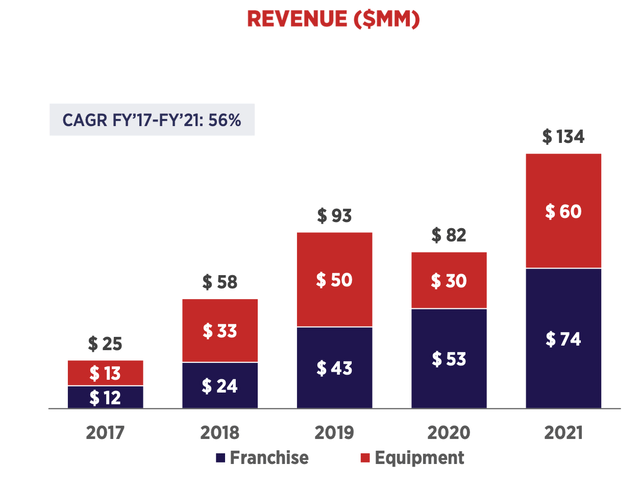

Between franchising revenue and equipment and merchandise revenue, there has been a general redistribution of contribution to total revenue.

In the image above, look closely at the general trend. From 2017-2019, equipment contributed more to total revenues. However, the distribution shifted shortly after that. Why?

Recall the discussion earlier pertaining to the recurring revenue streams F45 had from its franchising revenue segment. With 3,301 franchises by the end of 2021, there is a clear demand for F45 studios. With heightened demand, AUVs would have increased as well. In turn, many franchisees would be paying 7% royalties instead of the fixed fee. How can I support this? Just look at same store sales, which grew 12.1% over the period. To further support this, visits for 2021 reached a record 26,000, 31% over the previous year.

In terms of performance, revenues grew 62.8% over 2020, from $82 million to $134 million in 2021. Now, gyms were closed during the lockdowns, so 2020 is not a great base point to use. Instead, 2019 will be considered. Revenues grew 44% over 2019, from $93 million.

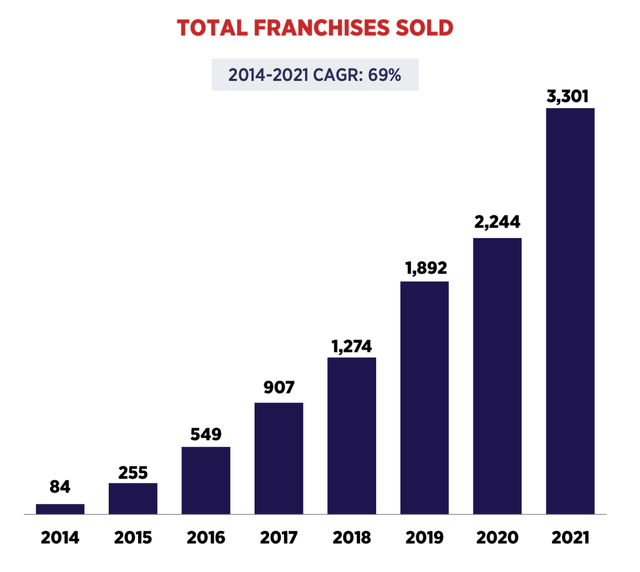

Revenue grew at a CAGR of 56% from 2017-2021, clearly fueled by the growth in both the new studio openings and franchises sold. 2021 saw the largest increase in franchise licenses sold (1,057) and I expect this number to continue growing in the future. From 2014-2021, franchise licenses sold grew at a CAGR of 69%.

Adjusted EBITDA and Net Debt

Adjusted EBITDA reached a record 39% in 2021, growing from 31% the preceding year and leaving a respectable $52 million to contribute to net income.

As of December 31, the company had $42 million in cash and equivalents and no debt obligations on its balance sheet.

Despite these positive signs, the company is not profitable yet. Its highest operating cost was SG&A at a whooping $180 million. This may seem terrible considering its nearly double its revenues. However, its clearly paying off with the growth in new visits and franchises sold. I expect this number to reduce drastically as the company reaches a point of auto-pilot, where these expenses are drastically reduced as customer acquisition cost comes down. The number of total studios grew to 1,749 in 2021, a CAGR of 85%! To support each of these studios, the company must increase their spending in the short-term. I am excited to see how they streamline it in the future.

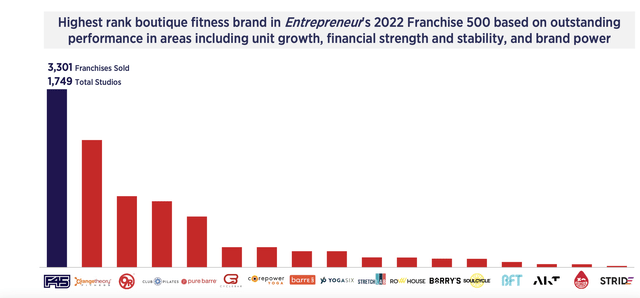

Growth Channels

Today, F45 claims it is the largest boutique fitness brand in the industry. With 1,749 total studios and 3,301 franchises sold, it boasts a large and powerful network. Its closest competitor, Orange Therapy, had a reported 1,314 studios as of April 4th, 2022. According to Entrepreneur’s Franchise 500, F45 is also the highest ranking fitness brand based on unit growth, financial strength and brand power.

So how will the company continue its growth?

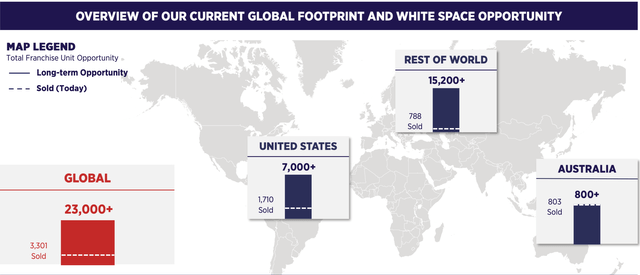

1) Expanding US, Australia and Rest of World Footprint

As discussed previously, F45 has a little over 1,700 studios across the United States. However, management has a long-term goal to open 7,000 studios in the future. This is actually not that difficult to do. Right now, there are roughly 1,500 studios in the pipeline. By this, I mean that 1,500 franchises were sold but not yet opened in the U.S. That means that instead of opening another 5,700 stores, the company has a long-term strategy to acquire licenses for another 4,200. At its most conservative level, the 5,700 stores would bring in at least $14.2 million at the $2500 fixed rate monthly. Yearly, this would translate into $170 million yearly for U.S. royalties for just the new stores opened. When combined with the current studios opened, it translates into $175 million for the U.S. yearly. Now, we know that AUVs have drastically increased, turning much of these fees into variable ones. So, I am being really conservative here.

Australia is F45’s next biggest market. So far, the company has sold 803 franchise licenses, but estimates it can double that number in the future. Let’s say it does double in the future to 1,600. This would translate into $4 million monthly and $48 million annually at the fixed franchise rate.

The global expansion represents F45’s biggest opportunity. So far, there are roughly 788 franchise licenses sold, but management estimates it can sell another 14,412 in the future. Once again, let’s say they pull this off. 14,412 stores at $2500 would equate to $36 million a month and $432 million yearly at the fixed rate. While I am a little more skeptical with 14,000 openings globally, it’s not impossible.

All in all, if these growth strategies come to fruition, the company will earn just over $650 million at its most conservative fixed rate. At the variable rate, the game completely changes.

2) Grow Same Store Sales to Generate Higher Royalties

As previously mentioned, same store sales grew 12% in 2021, contributing to a higher AUV per store. By continuing to focus resources on marketing and increased SG&A, I expect a payoff over time. Furthermore, F45 is partnered with a number of celebrities, some of which are investors in the company. One of which is Mark Wahlberg, known for his quality acting and high performance exercise. I believe this will bring more customers to F45 as he continuously promotes the brand to his millions of followers.

Growing AUVs above the minimum threshold will allow the first growth strategy to really be capitalized as franchisees end up paying more than the $2500 fixed fee monthly. It’s also a buffer. If the exact number of openings never come to fruition, a variable franchisee fee will likely contribute just as much.

3) Expanding into New Channels

Another way the company will grow both the number of franchises it sells and increase same store sales is by focusing on growing into new channels, some of which exploit different demographics.

Some of these channels include:

1) High Schools and Colleges: currently in 35 colleges and universities, including Stanford, University of Southern California and the University of Texas at Austin

2) Government: F45 operates in a number of government offices and continues to grow this channel. One of which is the U.S. Department of Labor

3) Corporate: F45 has begun capitalizing on the opportunity to acquire a number of corporations, who become ever more focused on employee health and wellness. Recently, F45 opened a number of studios in BDO, Hilton and Northrop Grumman

4) New Modalities: The company is actively trying to penetrate new demographics to grow both its brand influence and footprint by targeting new modes of exercise. One of these is FS8, which focuses on Yoga and Pilates. I am happy to see them exploit all segments of the boutique industry, which will allow them to see parallel growth alongside the bootcamp segment it focuses most of its resources on.

2022 Expectations and Beyond

With a current Adjusted EBITDA margin of 39% and gross margin of 75%, the question of eventual profitability is not concerning to me. Once its advertising ($16 million in 2021) and support expenses becomes under control, the FCF will start to grow as F45 focuses on continuing to grow its top line whilst simultaneously reducing its operating expenses.

Management is currently expecting revenues between $255 -$275 million for 2022, with adjusted EBITDA between $90- $100 million. In terms of revenue, management is expecting 90.2% growth at its base level. In terms of adjusted EBITDA, management is expecting an adjusted EBITDA margin of 35.2%. This is actually lower than the 39% for 2021, but I am happy to see management being realistic. EBITDA is really a measure of efficiency, and to achieve 90% growth, they will have to spend more on their operating expenses, which will evidently drive down adjusted EBITDA.

If we assume that revenue growth will decrease, but level out to about 15% per year (somewhere in line with where F45 currently is in the market and in line with the industry CAGR), we can see upwards of $600 million by 2026. In terms of EBITDA, I expect fluctuation as this company continues to grow. If it averages 34% over the next 5 years, we could be looking at roughly $200 million in EBITDA by 2026.

Now, remember this all depends on management’s ability to control those costs while it grows. A lot of companies burn out because they can’t turn around their bottom line. I don’t see that becoming the case here. There’s a lot of opportunity for F45 in terms of eventually reducing its advertising and selling costs. One of which is the continuation of its footprint expansion. While this will lead to heightened costs in the short term, the effect will be drastic in the long term when enough people join that they can reduce the advertising cost.

Another way they can reach profitability is through synergies from their new modality strategy. By leveraging shared resources from multiple fitness segments, the company can lower costs. One of these resources is human capital. F45 makes its initial revenue through selling franchisees licenses. If they can utilize these same training methods and knowledge of the industry, F45 can lower SG&A.

Bottom Line

F45 has a bright future ahead. Management’s 2022 expectations is exciting for existing and prospective shareholders. Furthermore, its long-term growth plan speaks to the opportunities the company has to grow its top line by focusing on increasing AUVs.

The one real risk right now is that the company is not profitable despite heightened top line growth. My hope is that the company utilizes innovative solutions like those described before to reduce those costs as scaling will likely heighten them even more. Because of this, I am bullish on the long term, but will wait until I see profitability trend positively. Therefore, I am issuing a HOLD rating.